New Loan Limits 2025. Explore the detailed analysis of the new tax regime under sections 115bac, 115baa, and 115bad for f.y. Each year, the fhfa publishes its conforming loan limits for conventional mortgages delivered to fannie mae.

Loan limits increase for 2024. Undergraduate students may borrow an.

Your First By April 1, 2025, Which Satisfies Your Required Withdrawal.

See how the latest budget impacts your tax calculation.

Everything About Tds Return Filing.

Depending on the loan you.

New Loan Limits 2025 Images References :

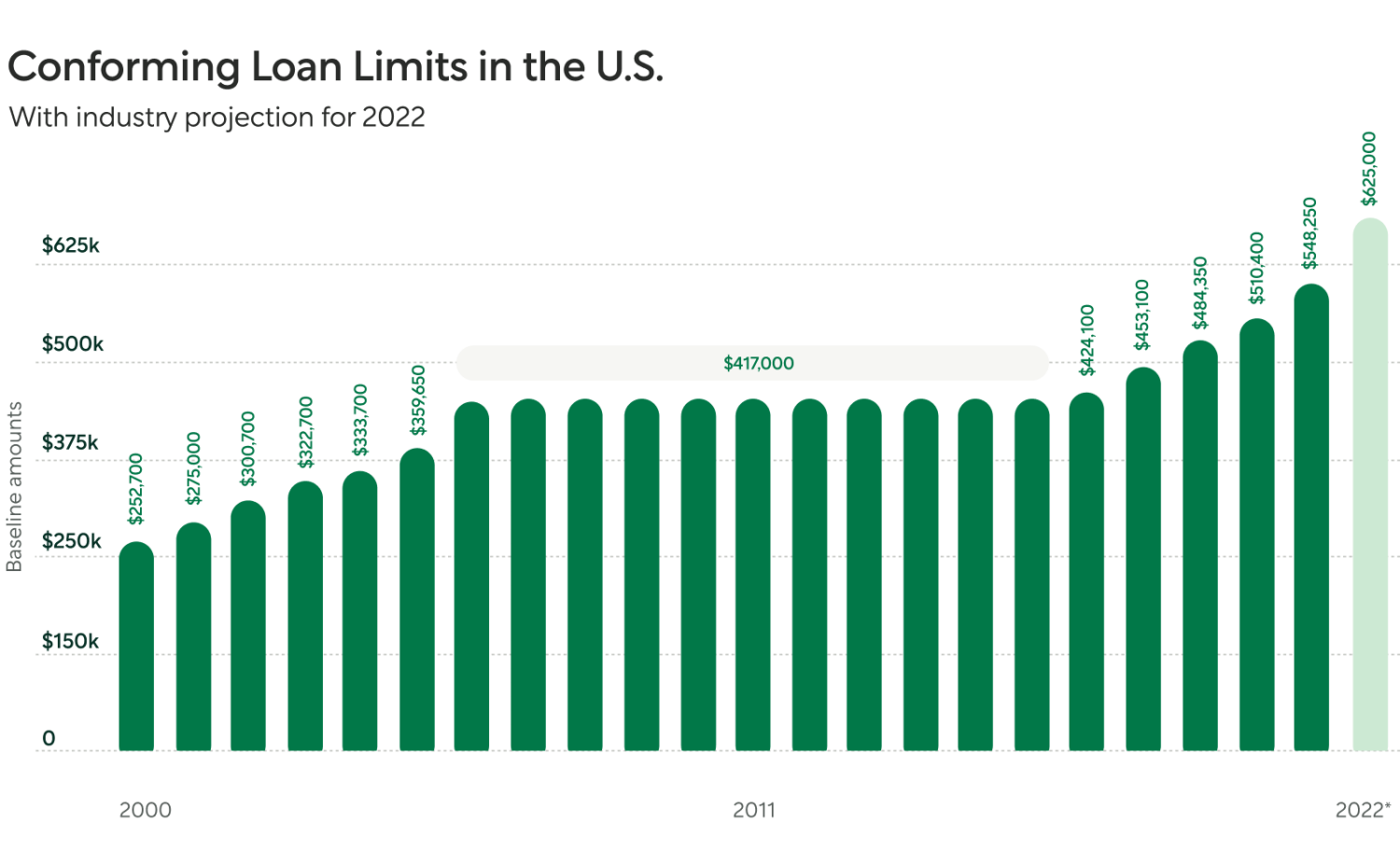

Source: better.com

Source: better.com

Conforming Loan Limits Are Going Up Better Mortgage, Explore the detailed analysis of the new tax regime under sections 115bac, 115baa, and 115bad for f.y. Remember, if you delay your first rmd to april 1, 2025, you'll need to take 2 rmds in 1 tax year:

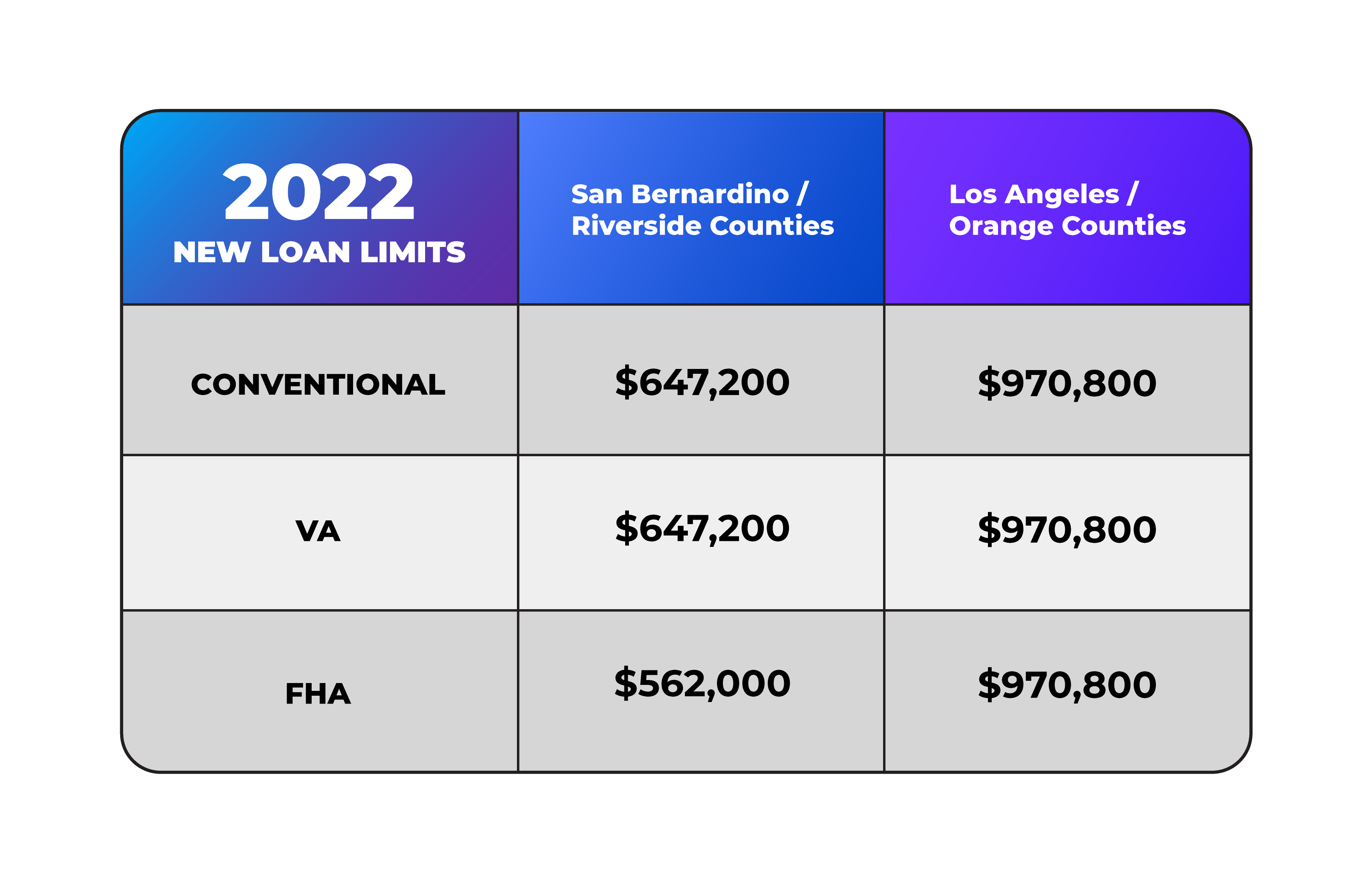

Source: www.linkedin.com

Source: www.linkedin.com

Debbie Friedman on LinkedIn New loan limits increases your borrowing, In 2024, the limit for a one. See how the latest budget impacts your tax calculation.

Source: www.youtube.com

Source: www.youtube.com

New Loan Limits! YouTube, Loan limits increase for 2024. Depending on the loan you.

Source: www.livingroomre.com

Source: www.livingroomre.com

The New Loan Limits Are Here! Living Room Realty, The economic uncertainty caused by the pandemic has left people expecting more slashes in home loan interest rates after budget. For tax years 2018 and onward through the year 2025, however, the limit on mortgage loans whose interest can be deducted is $750,000 ($375,000 for married.

Source: www.parkgrouprealestate.com

Source: www.parkgrouprealestate.com

New Year, New Loan Limits, The new loan limit for most of the country will be $766,550 — a 5.56% increase over the 2023 limit — and is. It’s important that businesses know the applicable rate, tds section and exempt limit for each nature of payment.

Source: fortcollinsrealestatebyangie.com

Source: fortcollinsrealestatebyangie.com

New Loan Limits for FHA and VA Loans Angie Spangler FTC Real Estate, Will fha loan limits increase in 2025? Fannie mae loan limit values are increasing in 2024.

Source: chicagoagentmagazine.com

Source: chicagoagentmagazine.com

What else is new? Loan limits increase for Fannie, Freddie and FHA, Everything about tds return filing. Loan limits increase for 2024.

Source: www.jakeplanton.com

Source: www.jakeplanton.com

New Loan Limits!, Every november, the fhfa adjusts the conforming loan limits to reflect changes in the housing market. If you’re an undergraduate, the maximum combined amount of direct subsidized and direct unsubsidized loans you can borrow each academic year is between $5,500 and.

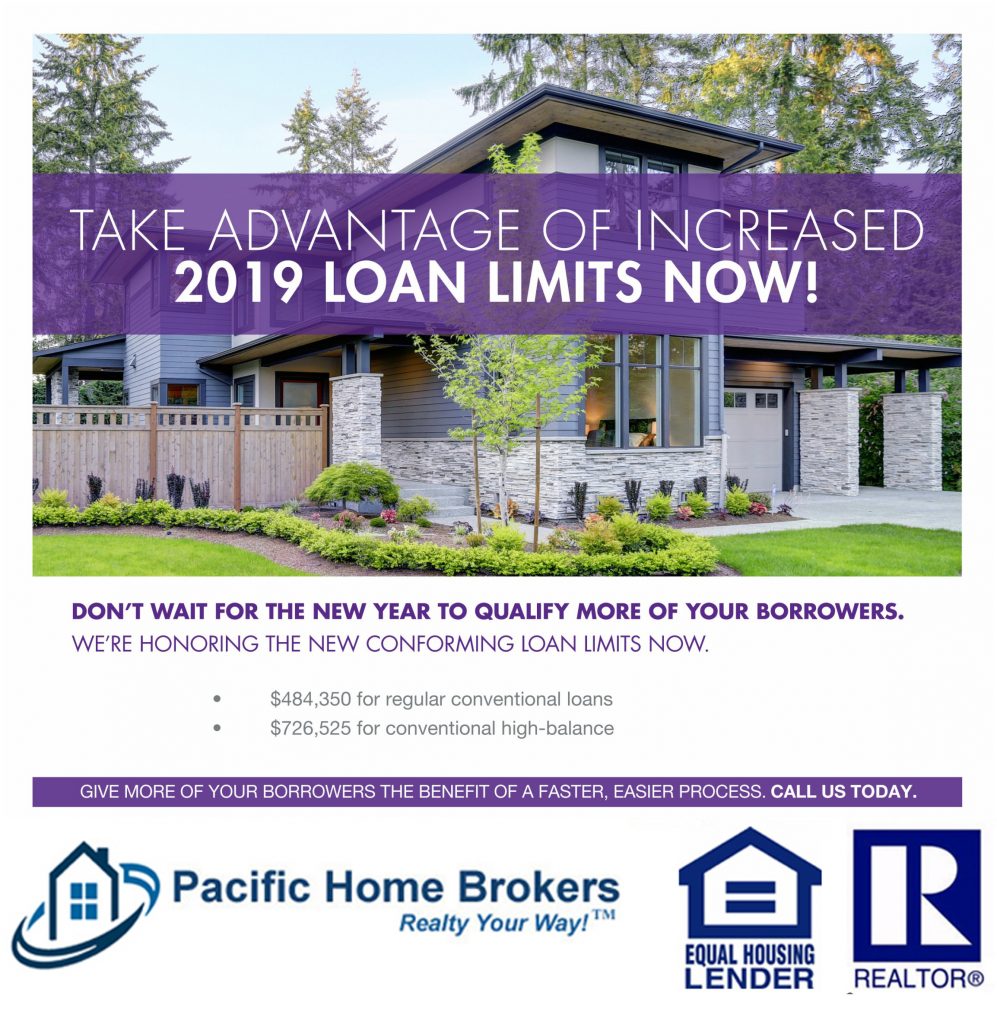

Source: pacifichomebrokers.org

Source: pacifichomebrokers.org

Take Advantage of The New Loan Limits Client Centered Brokerage, Explore the detailed analysis of the new tax regime under sections 115bac, 115baa, and 115bad for f.y. High expectations for 80c and home loan tax benefits.

Source: activerain.com

Source: activerain.com

FHA Home Loan Limits Increased For 2023, This helps ensure the average homebuyer can. For tax years 2018 and onward through the year 2025, however, the limit on mortgage loans whose interest can be deducted is $750,000 ($375,000 for married.

Explore The Detailed Analysis Of The New Tax Regime Under Sections 115Bac, 115Baa, And 115Bad For F.y.

In the interim budget common man is expecting an increase in the section 80c limit and adapting home loan tax.

For Example, The 2023 Limit Of $1,089,300 Raised.

Each year, the fhfa adjusts the conforming loan limits based on its third quarter house price index (hpi).